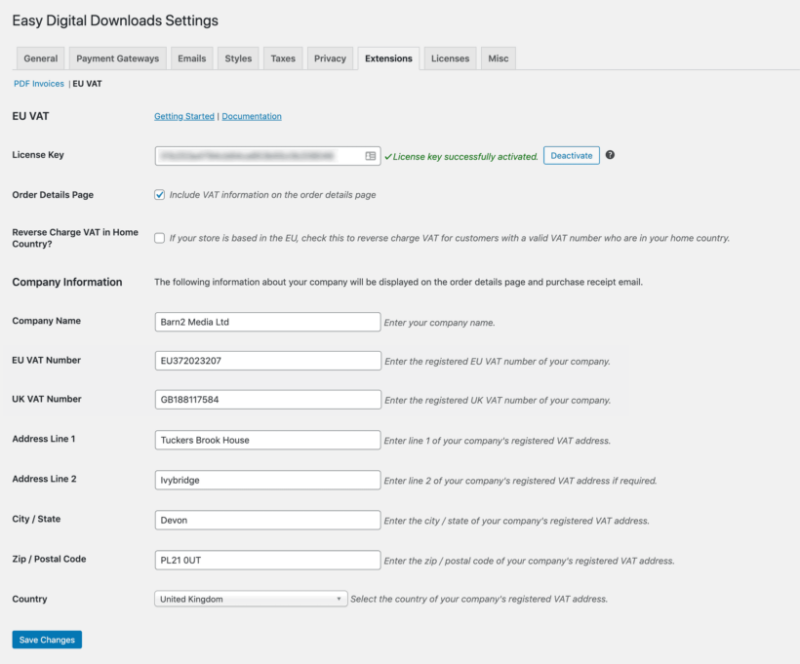

EffectIO Easy Digital Downloads - EU VAT 1.7.2

Original price was: $70.00.$9.99Current price is: $9.99. / year

Original price was: $70.00.$9.99Current price is: $9.99. / year

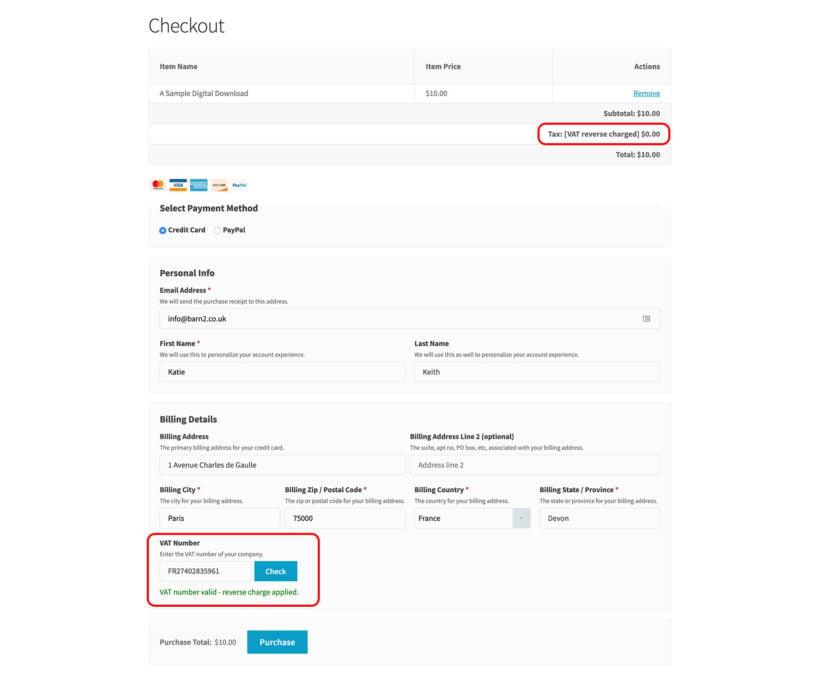

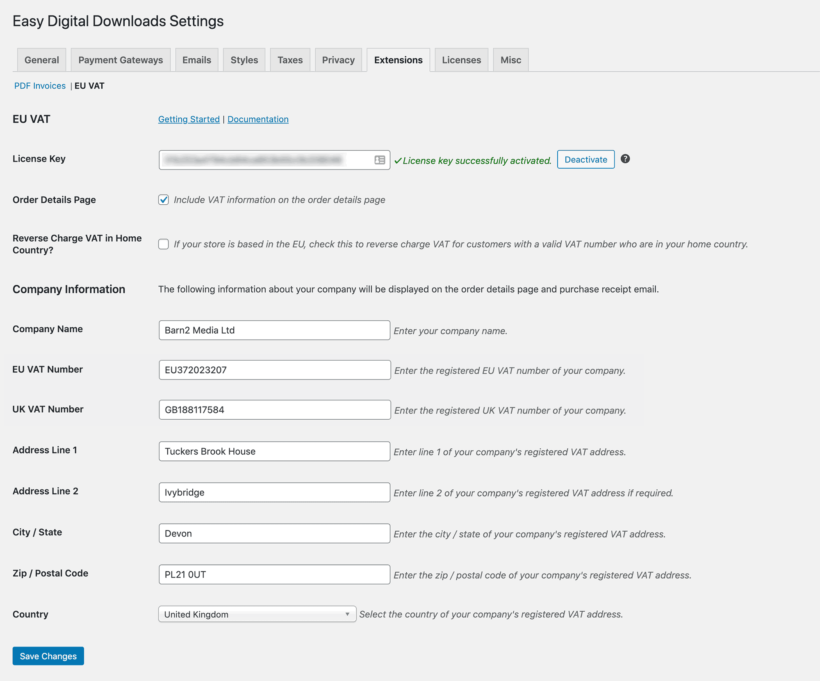

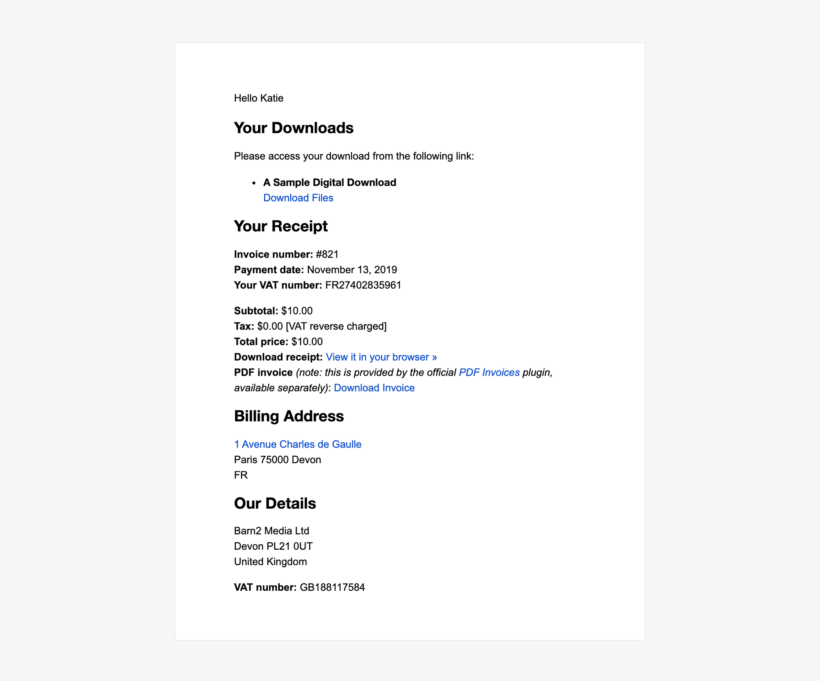

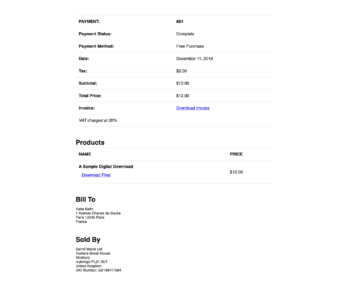

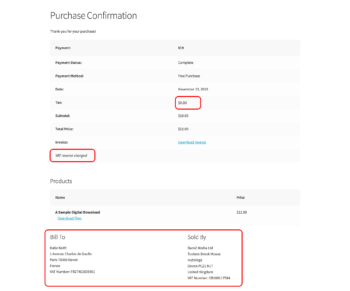

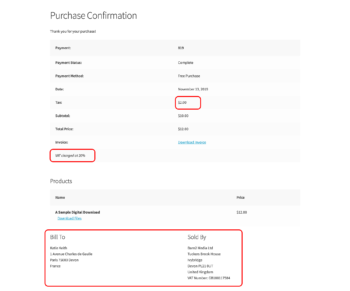

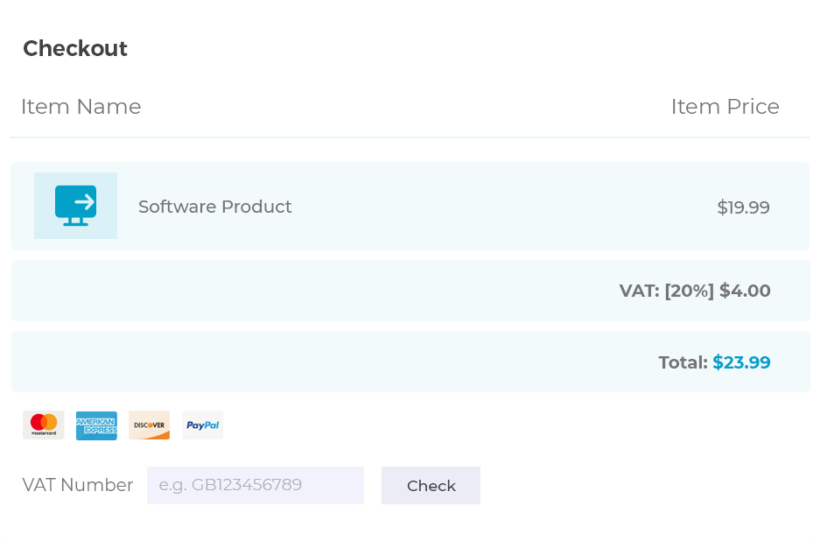

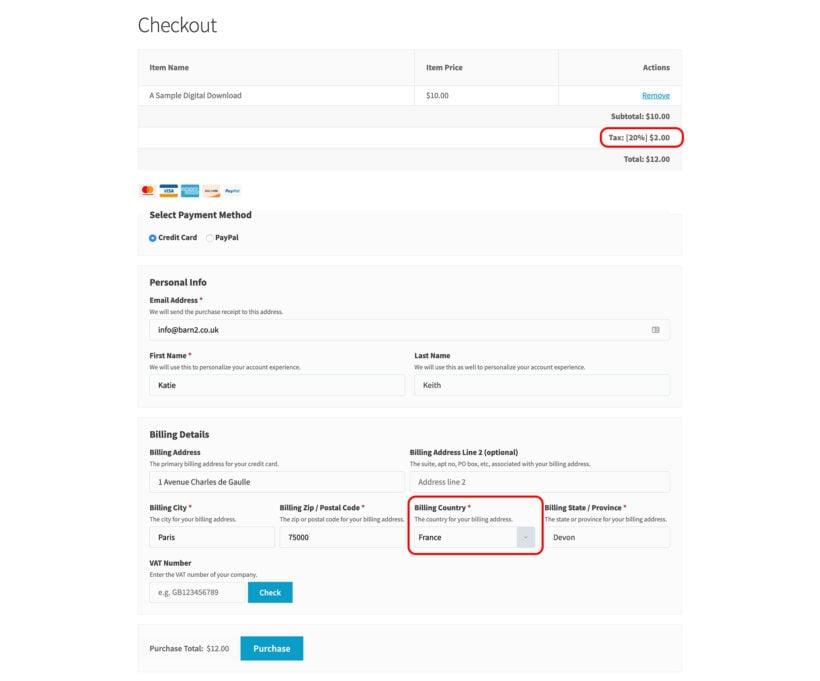

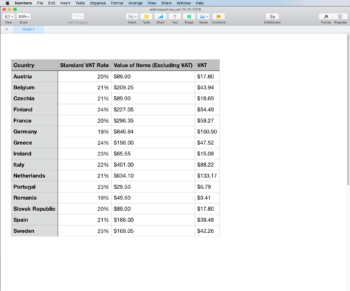

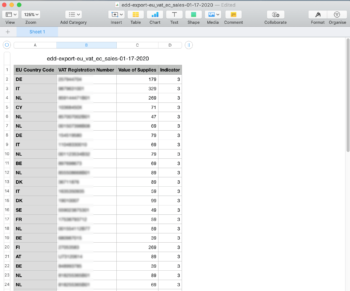

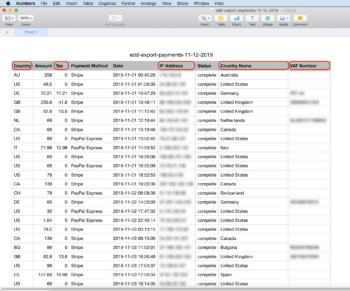

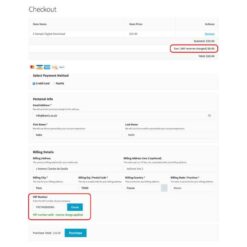

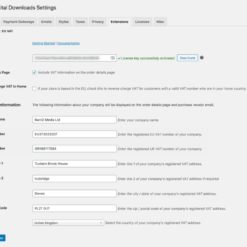

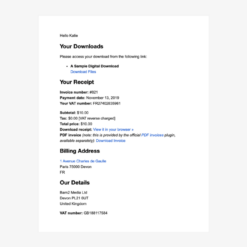

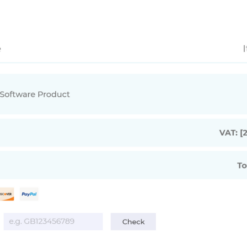

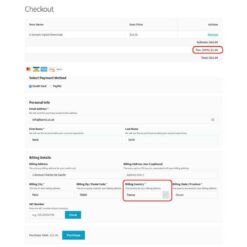

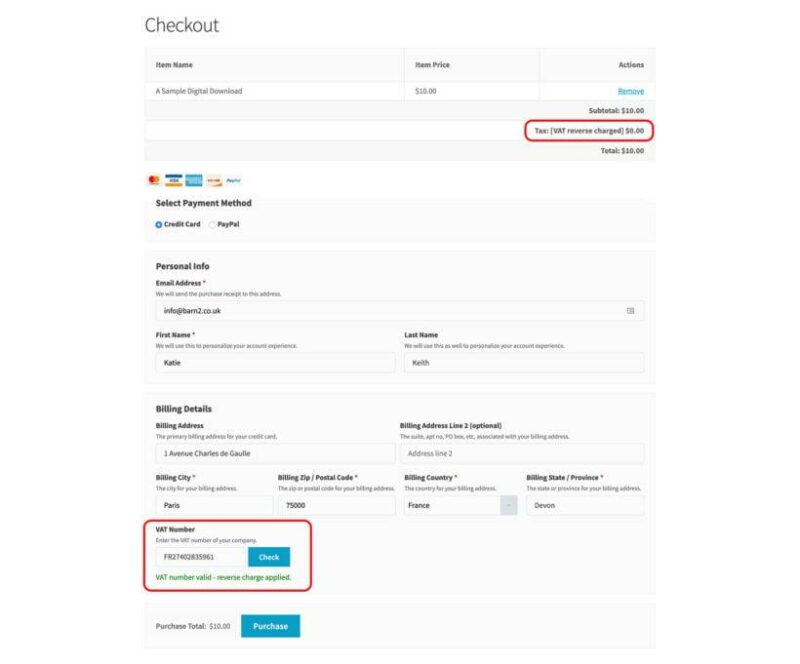

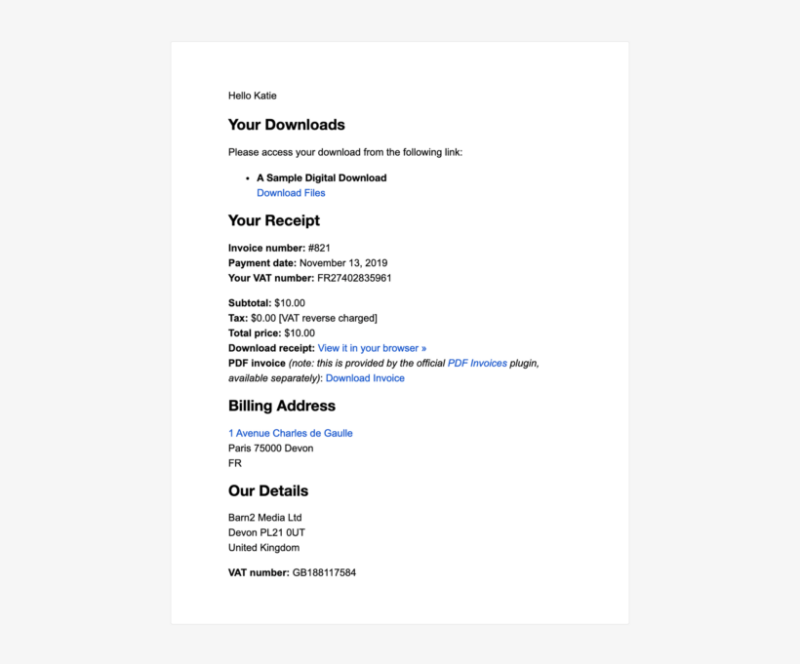

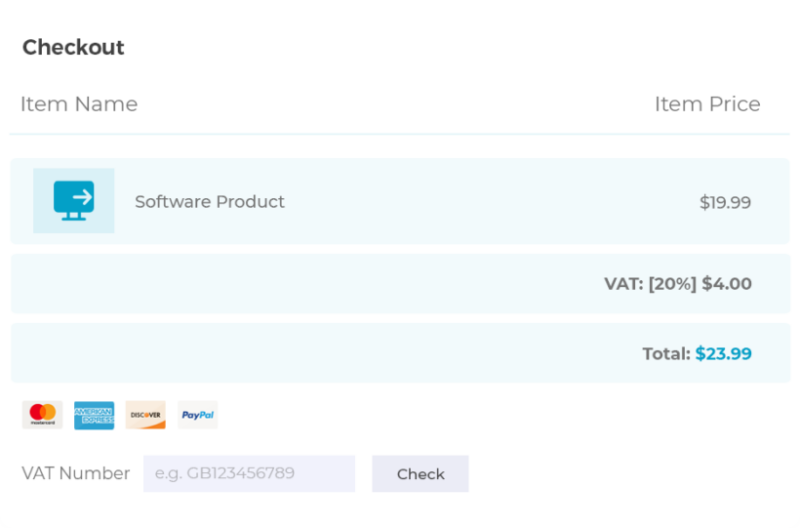

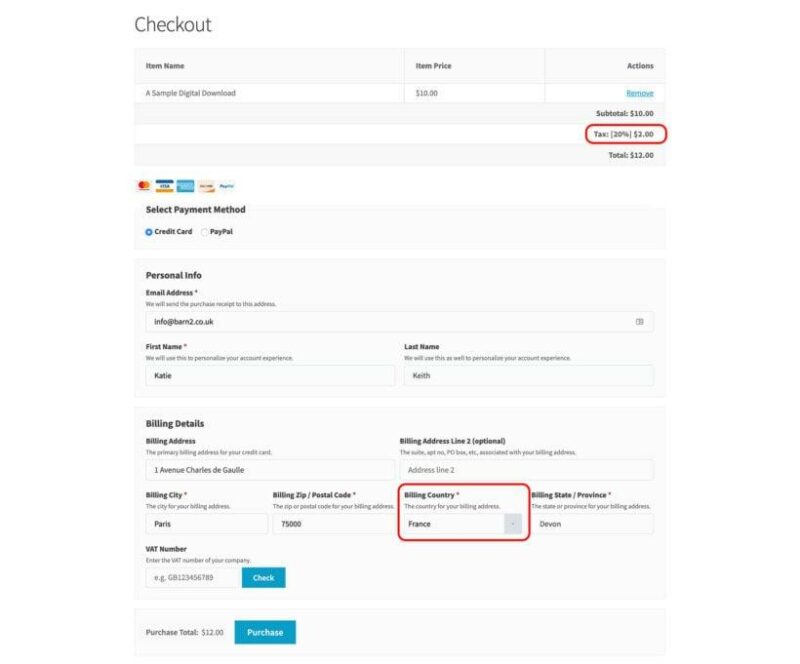

Adds EU VAT support to Easy Digital Downloads. Version: 1.7.2

Released on: 2025-10-30

Single License

- Latest version of the plugin

- Activation Keys or Pre-activated

- Direct Download / EffectIO Dashboard

- All future updates for one year

- Automatic Updates

Club Membership

- 2830 Plugins and Themes

- 15 Downloads / Day

- Direct Download / EffectIO Dashboard

- Regular updates

- Cancel anytime

NEW Open access to the site manager! Update all your sites and install all premium plugins and themes, now with 38% Discount.

Sites Manager